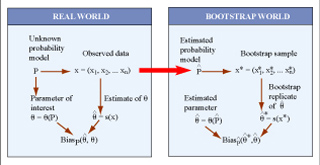

Bootstrap, discussed in Lecture 9, is a re-sampling method which can be used to evaluate properties of statistical estimators. This course covers Bootstrap and other methods used in financial analysis. (Image by MIT OpenCourseWare.)

Instructor(s)

Prof. Leonid Kogan

MIT Course Number

15.450

As Taught In

Fall 2010

Level

Graduate

Course Description

Course Features

Course Description

This course covers the key quantitative methods of finance: financial econometrics and statistical inference for financial applications; dynamic optimization; Monte Carlo simulation; stochastic (Itô) calculus. These techniques, along with their computer implementation, are covered in depth. Application areas include portfolio management, risk management, derivatives, and proprietary trading.